რა შეიცვალა?

2018 წელს ფინანსურ სფეროში განხორციელდა უმნიშვნელოვანესი ცვლილება, რომელმაც ძირეულად შეცვალა სახელმწიფოს მიდგომა. კერძოდ, თუ აქამდე კომპანიებს, იშვიათი გამონაკლისების გარდა, საკუთარი ფინანსური მონაცემების გასაჯაროების ვალდებულება არ გააჩნდათ, 2018 წლიდან ეტაპობრივად ამოქმედდა ფინანსური ინფორმაციის გამოქვეყნების ვალდებულება.

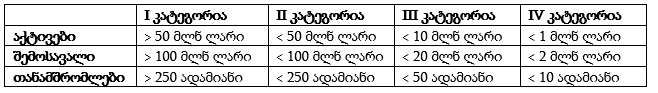

კერძოდ, კომპანიები დაიყო ოთხ კატეგორიად:

პირველი და მეორე კატეგორიის საწარმოებს 2017 წლის ანგარიშგების ჩაბარების ბოლო ვადა განესაზღვრათ არაუგვიანეს 2018 წლის 1 ოქტომბრისა.

მესამე კატეგორიის საწარმოებს 2018 წლის ანგარიშგების ჩაბარების ბოლო ვადა განესაზღვრათ არაუგვიანეს 2019 წლის 1 ოქტომბრისა.

მეოთხე კატეგორიის საწარმოებს 2020 წლის ანგარიშგების ჩაბარების ბოლო ვადა განესაზღვრათ არაუგვიანეს 2021 წლის 1 ოქტომბრისა.

რა კატეგორიაში ხვდება ჩემი კომპანია?

საწარმოთა კატეგორიებად დაყოფა მოხდა მათი ზომების მიხედვით. ზომა დამოკიდებულია სამ კრიტერიუმზე: 1) აქტივები; 2) შემოსავალი; და 3) თანამშრომელთა საშუალო რაოდენობა წლის განმავლობაში. კონკრეტულ კატეგორიაში მოსახვედრად კომპანია უნდა აკმაყოფილებდეს ამ სამი კრიტერიუმიდან მინიმუმ ორ კრიტერიუმს. ქვემოთ მოცემული ცხრილი დაგეხმარებათ თქვენი კომპანიის კატეგორიის დადგენაში:

უწევს თუ არა ჩემს კომპანიას აუდიტი?

ახალი რეგულაციის თანახმად, აუდიტი უწევს მხოლოდ პირველი და მეორე კატეგორიის საწარმოებს. სხვა სიტყვებით რომ ვთქვათ, პირველი და მეორე კატეგორიის საწარმოებს გარდა იმისა რომ უწევთ ფინანსური ინფორმაციის გასაჯაროება, გამოქვეყნებამდე უწევთ ამ ინფორმაციის სავალდებულო აუდიტი. რაც შეეხება მესამე და მეოთხე კატეგორიის საწარმოებს, მათ არ უწევთ სავალდებულო აუდიტი, რაც იმას ნიშნავს რომ მათ მხოლოდ ევალებათ ფინანსური ინფორმაციის მომზადება და გასაჯაროება, თუმცა არ ევალებათ ამ ინფორმაციის აუდიტი მის გასაჯაროებამდე.

რა მოხდება თუ ჩემმა კომპანიამ არ ჩააბარა სავალდებულო ანგარიშგება?

ამ კანონის მოთხოვნების შეუსრულებლობა იწვევს კომპანიის დაჯარიმებას. წერილობითი გაფრთხილების შეუსრულებლობის ან პასუხისმგებლობის დაკისრებიდან ერთი თვის ვადაში შესაბამისი მოთხოვნის შეუსრულებლობის შემთხვევაში კომპანიას ორმაგდება დაკისრებული ჯარიმის ოდენობა.